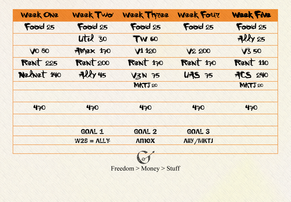

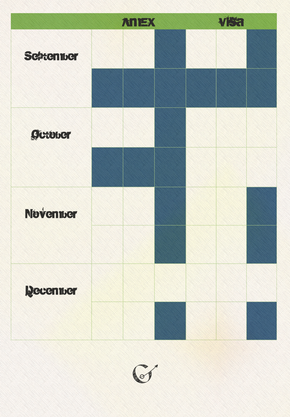

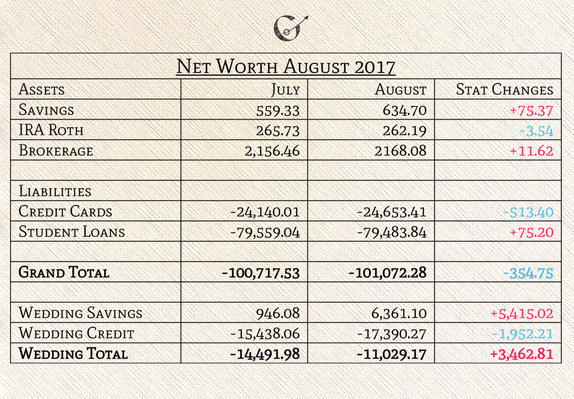

Welcome to September! The first week in September means that it’s time for August’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me pay closer attention to my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend tracking net worth because it has been such a helpful tool to see my personal finances stat changes all in one place. Summary of activity: I got married! We had a fun time and a big party. The wedding financial sandstorm has subsided and I can tell my regular finances are no longer being buffeted. I also still have some clean up to do after June’s rent-check sludge wave, but I have researched solutions and have a plan to get everything spotless. My assistant returned to school after working with us all summer. They did an awesome job covering for me while I was getting hitched. Meanwhile, one of my supervisors has been out a lot this last month dealing with family matters. So, it’s mostly been my new supervisor and me for the last two weeks. I had a good conversation with my boss about the possibility of a raise, but I don't expect to see results for another two weeks. However, if nothing advances by Sept 25th, I will have to start echo voice asking them what's happening. I can't wait forever to figure out what I'll be doing in January. Income Unusualness: I have been able to work a little over my budget required hours. Overall Budget: Since the wedding, my budget payment schedule is returning to the usual paying bills on the weekends. I will be cleaning up June’s sludge wave in September. Part of that plan is to reevaluate how I use my food checking account.  Budget for September 2017 Budget for September 2017 Budget changes: September is based on June. I primarily adjusted the rent to accommodate for the rise in rent. I also adjusted how I will be saving some of my money. I left ACS the same and my husband got our Spectrum bill lowered back down. Net Worth: My net worth dropped again and I will keep riding it out for now. Since the wedding is over, I can devote more time to getting a raise, or finding a new job, and training my financial pokémon team. Savings Accounts: My rent savings recovered about 50% of what I used to purchase my passport in July. Ally savings also absorbed a nice little deposit. As part of cleaning up the sludge wave, I am in the process of rebalancing how I use my savings and checking accounts as part of my financial pokémon team. Right now, I'm planning on switching out my rent savings with a money market account and my Digit account with a Way2Save account. Investments: My Roth IRA is doing quite well. My husband and I have discussed using some of our wedding gift money for our retirement accounts, but we'll see. Blackrock went up this month as it just surfs the market. My Acorns is currently giving me a market gain of 9.61%, with a total loss of 1.91%. I have not linked it to my new checking account yet, and am biding my time until I have my financial pokémon team trained a little more.  Credit Card PP Tracking Sheet for Sept.-Dec. 2017 Credit Card PP Tracking Sheet for Sept.-Dec. 2017 Credit Card Relationship: My Visa has well-behaved as usual. As for my Amex, I knew it was getting locked-up in September, and I continued to struggle with stance changes. I found myself trying to buy stuff while I still could, like the few times I said, “I should buy the pizza because in September I won't be able to.” I also was trying to keep the card out of my wallet to protect me from my careless swiping. For September, I have updated my credit card pp tracking sheet. I am not doing the no-spend month challenge, but I gave Amex very low pp. I gave a little more pp for the Visa only because I anticipate using it more in October when we go on our honeymoon. Credit Card Extra Thoughts: I still am pining for a new credit card. My newest scheme is to rationalize getting one for our honeymoon. I have not found a card that is practical for both the trip and my daily life yet. I'll keep looking though. Student Loans: These continue to be sturdy and have been a forretress for me, but that may change in the following months. I budgeted my ACS payment as I did in June to prepare for possibly lowering it again in October. ACS did surprise me this month when I notice that I mixed up a few of my payment amounts for July's payment. The order of four loans was different when submitting the payments than the order I had written in my notebook. Thus, some loans were paid lower than I intended to. None of the loans were paid less than what was due, but one loan did increase from “$0.00 due” to “$0.83 due.” I managed to tough it out. ;) Wedding accounts: Savings increased with the helping hand of our wedding gifts. Now, we just have to figure out the best way to use it. So far, we’ve had a few pleasant conversations about what to do and I expect a few more before we arrive at a solution. Our line of credit also increased as we made our final wedding payments. I still anticipate a little more increase over the next couple of months. My husband has some wedding purchases on his introductory, 0% interest rate credit card at the moment and we want to take advantage of that rate as long as possible. Other notes: While I wait for the result of my raise conversation, I am evaluating how my financial pokémon team is functioning and determining if I can train it to be better at preventing future sludge waves. Over these last few weeks, I have been doing a lot of research. This week, I start calling companies and banks to get the rest of the information I need to finalize my plan on how to train my team. It was an exciting minun month. All right September, let’s clean up this sandy and sludgy mess. Let’s chat: How were your finances in August? How are you preparing financially for fall? Further reading: Rockstar Finances Blogdex Net Worth Tracker- almost 400 other bloggers’ net worths July 2017 Review and Net Worth Update- Last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My husband’s finances are not included. I include our wedding accounts on a separate line because it’s a gray area for me. The numbers are taken from each month’s statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing by removing any prior attachments, emotional or otherwise, so I can look at the numbers as just numbers. (In my excel file, I don’t use commas either.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file, they are all in black.)

5 Comments

9/3/2017 08:50:31 am

Interesting update! One thing that helped me when I was getting out of debt was 1. not using or taking on anymore debt. and 2. focusing all my efforts on removing the debt.

Reply

9/3/2017 10:15:50 am

Thank you for your advice. I appreciate it. I started working on gaining control over my credit card spending two years ago, but my wedding has really tested my new way of thinking about my credit cards. I can tell that I view it differently than I did two years ago, but I know there is still a long route of change still ahead of me. It's time to hop back on that tauros and ride until I can gain control.

Reply

9/3/2017 09:13:12 pm

Congrats on making that final wedding payment! Feels good, huh? :) And I'm keeping my fingers crossed that your raise conversation will be so awesome that you'll Echoed Voice about it all over the internet. ;)

Reply

9/6/2017 01:33:03 pm

Thank you for the encouragement! It did feel good, but I'm ready to start tackling our line of credit.

Reply

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed