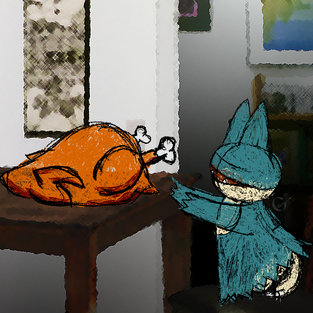

Now that Thanksgiving is over, we are officially in the holiday season. Tis the season for joyous times with family and friends, an abundance of delicious and fattening foods, and extra reasons to spend money. In my experience, this is the most challenging time for a lot of people to not cheat on their diets and budgets. Diets and budgets are a bit like the attacks ice ball and rollout. They may be different types, but they basically do the same thing. The more times the user hit’s their target, the stronger the attack grows. If the user misses, just once, it feels like they are starting over from the very beginning. Unlike the attacks, the goal of my diet and budget are to make them a part of my permanent lifestyle, so if I do mess up I don’t have to start all the way back at the beginning. However, there is long battle ahead of me before I reach that goal. Whenever I cheat, it lowers my attack’s power and makes the battle longer. There are three ways that I typically cheat on my budget, planned cheating, spontaneous cheating and last-minute cheating. Planned Cheating

Planned cheating resembles more of how my budget wants me to cheat. It involves planning and preparing to cheat in the future. One way I do this is to stockpile money with the intention of cheating. The other way is to prepay in small increments. Before we went on our honeymoon, I set aside some extra spending money the month before. Once on our trip, I had the assurance I had extra spending money if I wanted it. This was guilt-free cheating because I had protected my credit cards from a bunch of damage. Last years’ Thanksgiving I knew we were attending two different dinners and I was going to bring a pie to each. So, I bought the ingredients on sale gradually as part of my groceries the month before. By buying my supplies in increments, I protected my credit cards from a full-powered swipe Thanksgiving Day. Spontaneous Cheating Spontaneous Cheating is when I cheat on my budget without time to prepare and I develop a plan for recovery instead. This tends to happen more than planned cheating because I like to think of myself as spontaneous. I always have a very clear understanding of much damage spontaneous cheating will cause, and how much work it will take to recover the lost hit-points. While preparing for the release of Ultra Sun and Ultra Moon, I started to think about how the next core Pokémon games are planned for the Switch. My husband and I are not super excited about this. For us, it means that we will probably need our own Switch consoles to play the games. Then one day, I decided now was the best time to get it. Convincing my husband was the hard part. My list of reasons to buy it now included it making sense to buy one sooner and the second later, they will be rarer to during the holiday season and we it could encourage us to finish writing our wedding Thank You cards. I understood that the damage would be about $400. My recovery plan was to use a new payment tool on my American Express to pay it off in three months. So, I bought it and started my recovery. Last-Minute Cheating Although my subconscious wants to call this “emergency cheating”, it’s typically not an emergency. Last-minute cheating is when I wait until the last minute to make a financial decision to cheat or not. Usually, my indecision causes damage that has increased to an unreasonable amount. It always involves my credit cards and disregards all financial planning and respect for my financial well-being. Stress accompanies this cheating because I feel arena trapped with no other option than to swipe my credit card. Traveling has been the biggest offender. This year we were planning for a Montana Christmas. I looked at plane tickets in September when tickets cost about $500 each, and thought the prices would go down if we waited. However, we waited too long, and ticket prices doubled! After I considering not going this year due to lack of funds, my lovely husband listed important reasons that we needed to make it this year. It will be the first time since my grandmother died in 2006 that this many of my cousins will be together at the same time. We also won’t be back in two years because we are planning to run the Disney Marathon. After that, we may have our own family and might not be able to travel for Christmas. This could be our last opportunity for a Montana Christmas. He eventually convinced me to spend the credit. I really dislike making decisions when I feel like I’m weakening my financial health. I know that these types of decisions are why my debt weighs more than an Alolan Exeggutor and I need to carry it around in a heavy ball. Although I have improved over the years, the battle is nowhere near over. I want to think that with time and a lot of work, someday I won’t feel as compelled to cheat. Training my financial pokémon team is helping me grow and evolve my financial habits so they can eventually sustain themselves. Let’s chat: How do you cheat on your budget? Further Reading: How to Not Gain Weight During the Holidays- Nerd Fitness Budget Smart Now- Enjoy Great Holidays Later- Get Rich Slowly

0 Comments

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed