Welcome to February which means that it’s time for January’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth. Here I share these summaries so everyone can get an insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has naturally helped me pay better attention to my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend tracking your own net worth because I find it to be such a helpful tool to see everything all in one place. Summary of activity: It was back to a four-paycheck month which brought back a tight budget. I signed on to design costumes for a new show and took a weekend trip to Washington DC to see my family.

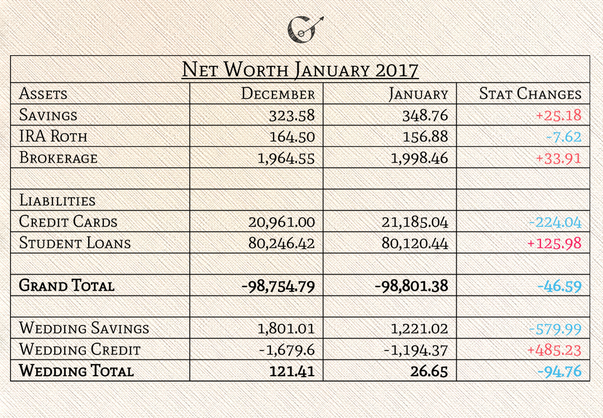

Income Unusualness: I got paid for that shopping gig in December. Of the $175, I sent $100 to wedding savings and used the rest for rent. I also got a $20 tip for taking measurements for a friend but immediately used it for a super potion and lots of Ganlon Apicot juice. Overall Budget: It being a four-paycheck month kept things tight, but I worked extra hours every week to reach my budgeted paycheck goals. I think I like the new leftovers section, but not that it has to be there. I hope to knock it off soon. For now, it definitely helps put things in perspective by showing me the excess bills I can’t easily budget for, see below. Just gotta keep up the side hustles. Budget Changes: I made it the month with groceries lowered to $25 a week, so I think that will be the new grocery budget for a while. I added a new section to my budget I am calling leftovers. It contains the leftover expenses that I can’t prepare to pay with just my anticipated income. It is not exciting to see but is very helpful to show me how much side hustling I need to do. I switched the Rent and Amex leftovers as I see how the second month with leftovers goes. Net Worth: It was not a bad decrease. $50 has been the smallest change since August and September 2016 when it changed $1.20. I want to think that this means that I finally have a wrap on my finances, but I won't know how strong it is for two to five months. First, I must do my best to not let this design gig muk up my finances like they usually do. Savings Accounts: The wedding account is still going strong, the extra $100 I deposited didn’t hurt. Our line of credit to savings ratio is still positive which is good, but our wedding spending is going to start double teaming us soon. Ally grew a little and can't wait to swallow some of the tax money I have stockpiled. The egg account, HM02 account, and unemployment account are definitely paused until after the wedding. Investments: My Roth IRA, still all in Nintendo stock, continues to shrink. I'm still hoping that the Switch release will help me break even. It has only been four months into having stocks with a base of $200, so it’s not like things are going horrible. I'm mostly glad I have a retirement account started before I'm thirty. My Acorns is currently giving me a +4.82%, which I find hard to believe. From what I saw this month it has just splashed about with nothing happening. But, it's February which means it’s time to xatu and readjust. Blackrock grew some, which is always nice to see. I haven't started a UTMA investment account for my nephew yet, but I am keeping it on my list and maybe I can get it started in March. Credit Card Relationship: I used most of my swipe pp (limit) but still have one spot left. Although I am let down that they went up, at least I can figure out why. I believe it was a mix of the Christmas trip being after statement dates and paying the final medical bills from last year. Credit Card Extra Thoughts: Whenever I start designing another show the debate for a business credit card returns. I want one because I am nervous about using my own credit cards and having the show mud bomb my finances like it usually does. However, I don’t want a new credit card until I know I can be more responsible. I look forward to the day I have a business account so it can only muddy up those waters instead. Student Loans: These continue to be relatively consistent with UAS and ASC going down and Nelnet going up. My total went down again, which I think is a result of my extra push from December on ASC. Other notes: The blog is still going well and I look forward to my first month using my blog and designing for a double battle. Being sick this first week gave this month a late start on my side hustles, but I’m sure I will be able to catch up. I am hoping I can find time to figure out Google AdSense, but that may have to wait until March. It was a pretty good minun of a month! I just need to keep working on and with my credit cards. How was your January? Have you started tracking your net worth yet? How are your resolutions or other goals going? Do you have any suggestions for me? Other Reading: The Ultimate List of Blogger Net Worth- over 280 other bloggers’ net worths December 2016 Review and Net Worth Update- Last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My fiancé’s finances are not included. I include our wedding accounts on a separate line because it’s a gray area I haven’t figured out yet. The numbers are taken from each month’s statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing because I can look at just the numbers without any attachment, emotional or otherwise. (In my excel file, I don’t use commas either.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file they are all in black.)

0 Comments

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed