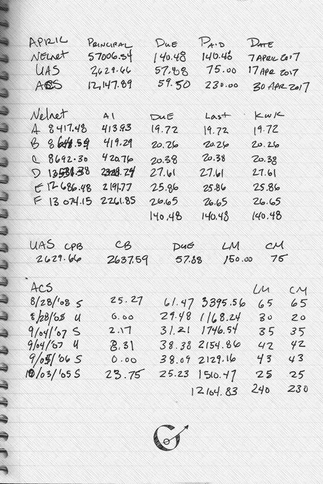

Six months after I graduated my loans entered repayment. It took me a little while to really understand what was happening with my loans. The summer after I started repayment I developed a notebook system for tracking my loans' stat changes that taught me a lot about my loans. It helped me understand my loans, the changes that occur with them and how much I still owe. Although I included a picture below of April 2017’s notebook page, that is not today’s topic. Today I wanted to finally introduce you all to my loans and my plan for paying them off. My boldore budget allocates money from my paychecks each month to keep my student loans well fed. We have developed a meal plan that it follows when determining how many payment puffs each loan servicer gets. Then each loan servicer has an individual meal plan that determines how those puffs get eaten by the individual loans they service.  Loan Notebook: page for April 2017 Loan Notebook: page for April 2017 My Overall Student Loan Meal Plan I am a big fan of what I call the roll out, or snowball, plan. I start by paying off my smallest loan first. Since it has a lower balance, or lower HP, by overpaying for it each month I can pay it off fastest. Once that loan is paid off, those payments lend a helping hand to the payments on the next smallest loan. The two payments combine to pay off the new smallest loan twice as fast. This pattern continues, like rollout, growing stronger payments as each loan gets paid off. My current meal plan for my student loans is to focus energy on paying off UAS and ACS while biding my time on Nelnet. Boldore distributes the payment puffs accordingly giving UAS and ACS extra to feed them quicker, and Nelnet exactly what it needs to maintain on-time payments. Once UAS and ACS are finally paid off, the plan is to move those payment puffs to Nelnet and overfeed it like a gulpin. Nelnet My Metapod Meet Nelnet. I have six loans with them, three subsidized and three unsubsidized, all from grad school. These are on an income based repayment (IBR) plan, which xatus my annual income and annually raises my monthly due payments accordingly. When this set of loans started repayment, I could pay my first few payments, but I knew that with my income those payments were not sustainable. Once I began my IBR plan, the government paid the interest on my subsidized loans for the first two years, which helped a lot. I chose loan A to overpay each payment by about $20 each month and I made huge progress. As my due payments increased each year, I stopped overpaying and started biding my time. The accrued interest on these loans continues to grow, raising the principal balances’ defenses. The current meal plan is to pay the amount due until either my other loans start getting paid off or I start making a lot more money. Once UAS and ACS are paid off, I will need to determine if I want to return to overpaying Loan A or if I want to pain split it between Loans A, B and C. This set of loans is expected to be paid off around 2037, so I will just keep chipping away until I get there. UAS My Paras Meet UAS. I have one loan with them from undergraduate school. It is on a standard 10-year repayment plan. The advantage this loan has over my other loans is that my budget sees it as one of three, not one of thirteen. This loan has a similar recommend monthly payment as ACS- 8/28/09S, but it gets paid $10 more than the ACS loan each month. My budget sees the $75 dollars for UAS as reasonable in comparison to the $230 it gives UAS. Although the two loans are similar, the UAS loan has smaller loans to compete with. A Pokémon trains fastest alone than with five other teammates wanting battle time. The current meal plan is to continue paying $75 a month on it until it is paid off. As I keep overpaying, my interest continues to eat less of each payment and allows for the principal to swallow more. I am anticipating this to be my next loan to be paid off. ACS My Weepinbell Meet ACS. I have six loans with them, four subsidized and two unsubsidized, all from undergraduate school. These are on a standard 10-year repayment plan. The strength of these loans is that ACS reduces interest rates as a reward system for consistent on-time payments. I don’t know the specific information because it appears to happen to random loans at random times. What I do know is that all of these loans have received the benefit at least once and the interest rates continue getting lower. The current meal plan is to overpay each month based on the recommended monthly payments while focus punching 8/28/08U until it’s paid off. Once paid off, those payments will move join the payments for 9/04/07U. I need to skill link my plan with this set because they keep attempting to fake me out with amount dues of $0.00. Closing Although student loans can feel like black sludge, they don’t have to be toxic. By having these meal plans set up with my budget, I can account for the damage and prepare for it. The plan has both UAS and ACS being paid off two years early. It just takes time and planning to rapid spin from the wrap of student debt. Let’s chat: Do you have student loans that you are paying off? What are your strategies for paying them off?

2 Comments

Nicole

10/9/2017 08:18:51 am

Hi! First of all, I just discovered your blog and I absolutely adore it. Bit of a geek and Pokémon-lover myself and just graduated from uni. I've landed my first job as a software developer and I've started battling my student loans as well. I believe the Netherlands has somewhat different rules considering repayment. Still, the amount is a bit overwhelming at times. I don't have to pay anything back yet, but I do want to train my financial Pokémon as much as possible. They need to be ready when the real battle starts ;) So I've started to track my expenses and created monthly budgets. Right now I'm setting up an emergency fund (I have zero savings). Once I reach 2000 euro's, I'm going to make a head start on my student loans. Keep up the great work with your blog!

Reply

10/12/2017 11:18:50 pm

Thank you for your kind words and congratulations on your new job! It sounds like you've got a plan on how to you want to train your team. Hold some luck incense and enjoy your journey in this new region of your life.

Reply

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed