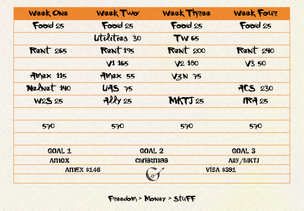

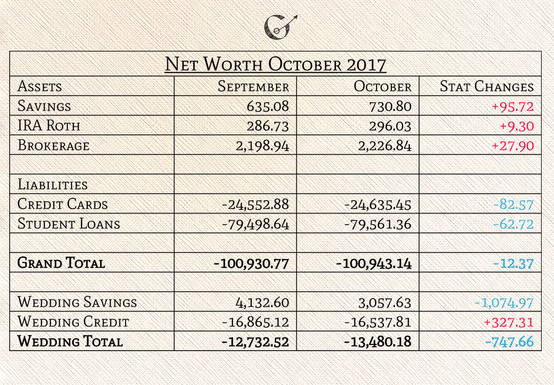

Welcome to the second half of November! I know I have been quieter than a whismur, but I am back and ready to talk. So, let’s pick up with October’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me keep a keen eye on my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend tracking net worth because it has been such a helpful tool to watch my personal finance stat changes over time. Summary of activity: October felt like a sharpedo shot out of a blastoise cannon, it ended about as fast as it began. We started the month packing bags for our honeymoon, and before I knew it, we were on a plane heading to Argentina. We had an amazing time! We spent the first few days in Buenos Aires learning about Argentine history. Then we visited El Calafate where we hiked on a glacier, went pokémon riding in the plains and saw a bunch of bergmite floating in the lake. We returned for less than a week before it became November. As for work, I started the month preparing a pair of shoppers to substitute for me while I was away. A new project manager was hired and started the week I was away. By the time we got back to the states, I couldn’t wait to meet her and get back to work. I also remembered how much I enjoy my job. Income Unusualness: There were a few weeks of overtime, but they compensated for the week I was away, since I could only use 35 hours of vacation time. Overall Budget: I did a little budget juggling as I prepared for the honeymoon. I wasn't 100% sure what my internet access would be exactly on the honeymoon. I paid and scheduled bill payments before we left so I wouldn’t worry seed about them and could relax. The first day there I spent my usual weekly grocery budget on lunch for the two of us, which made me flinch. My new financial pokémon team seems to be doing well for its first-month of battles. It got confused when saving for rent, but I think we just need some practice and maybe a persim berry.  Budget for November 2017 Budget for November 2017 Budget changes: October's budget seemed pretty successful, so I am trying it again for November. I changed the credit card interest growth to tracking the payment due for each card. I think for now it's more important to stakeout that amount so I can balance my budget accurately each month. Net Worth: My net worth barely decreased this month with its drop of $12.37. It could have been much further. Hopefully, November can sustain another small decrease instead taking a critical hit. Savings Accounts: My Ally savings statement date migrated to the end of the month and more accurately reflects each months’ growth. This month, I needed to use my emergency savings to cover my rent payment when it looked like my final rent deposits wouldn’t clear in time. I used some of my money from my Way2Savings for spending money on our honeymoon and appreciated light screening some of our wedding savings money. Investments: My Roth IRA, is still doing well. Starting with $200 a year ago, I feel it is making a great return. Now, I have finally started depositing $25 a month which will help it grow. My Acorns is currently giving me a market gain of 11.88%, with a total loss of .59%. For not having added anything since June, I find this remarkable. Now I just need to focus my energy on getting it linked to my main checking account again so it can water my acorns. Blackrock went up this month as it just surfs the market. Credit Card Relationship: I maxed out my PP on both cards. I didn't bring my Amex with me on the honeymoon, which was a good idea, but I used the swipes at home anyhow. I went over my visa limit by one pp, but I'm planning on keeping it stored safely on the pelago for November where it can stay out of trouble. I felt pretty confident about my credit cards until I looked at my net worth and saw they dropped over $100. I'd love to say that this trend won't continue, but we still had Christmas travel to a small town in Montana to pay for, and it wasn't cheap. Thankfully my credit cards won’t be unnerved by Christmas shopping this year, as our families’ souvenirs are doubling as Christmas presents. Credit Card Extra Thoughts: I still have high hopes that the pay increase will give them a lovely kiss so I can regain control. I currently have absolutely no urge to add a new credit card to my team anytime soon. Student Loans: Their sturdiness is starting to shake. It has finally happened, the monthly increase of Nelnet’s interest build up is consistently weighing down my student loan net worth. I reapplied for my Income-Driven Repayment plan, so hopefully, that will help out some. Reapplying was also the first time that being married has become a nuisance. Although I filed my 2016 taxes as single, I still had to include my husband’s tax information. Soon I should find out if getting married was helpful or hurtful for my loans. I knew this would be a part of marriage, but I wasn't expecting it so soon. Wedding accounts: Our wedding accounts are doing fine. My budget is starting to deposit some money into our wedding savings at least once a month because of the raise. We also keep chipping away at our line of credit. I want to make it go down much faster, but right now we have so much debt that I am choosing to sticky hold my debt payoff plan for now and reevaluate in 2018 once my student loans calm back down. Other notes: My new financial pokémon team appears to be running fine and will improve with some practice in November. We are starting to look into children. I feel we should stabilize our finances before trying to add another life to ours, but we'll see. There is still plenty of research and education to do first. It was an adventurous minun month. OK what’s left of November, let’s prepare for trouble, maybe even double, in December. Let’s chat: How were your finances in October? How have they been in November? Anyone returning to Alola this month with Ultra Sun or Ultra Moon? Further reading: Rockstar Finances Blogdex Net Worth Tracker- over 450 other bloggers’ net worths September 2017 Review and Net Worth Update- Last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My husband’s finances are not included. I include our wedding accounts on a separate line because I haven’t figured out how our accounts fit into my personal net worth. The numbers are taken from each accounts’ monthly statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing by removing any prior attachments, emotional or otherwise, so I can look at the numbers as just numbers. (In my excel file, I don’t use commas either.) I only show the current month and the one before for illustrative purposes. (My excel file contains the entire year.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file, they are all in black.)

4 Comments

11/21/2017 09:05:19 am

To be honest, us getting married didn't really affect our taxes. In fact, it made my husband mad because he was missing out on all these alleged tax benefits, hahaha. :) But I do admit it's easier filing jointly and getting a few discounts on the tax brackets.

Reply

11/28/2017 10:04:56 pm

I hope we manage to get some tax benefits. I know there were numerous other good reasons to tie the destiny knot, but some benefits would be nice too.

Reply

12/6/2017 03:07:42 pm

I haven't starting thinking about the potential costs of a wedding or a honeymoon, but I know it's going to cost me a large chunk of change when I do decide to take the plunge. It sounds like life has been super busy for you! I like reading through your breakdown of each section. Have you thought about setting goals yet for 2018 under your different categories?

Reply

12/7/2017 11:32:59 pm

I have indeed started thinking about goals for January through April 2018 and I keep them in my financial diary. I don't have a goal for each category, but my goal boomburst makes sure to hit each category.

Reply

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed