Welcome to March which means that it’s time for February’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous month. Here I share these summaries so everyone can get an insight to my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me pay closer attention to my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend tracking net worth because it has been such a helpful tool to see my personal finances stat changes all in one place. Summary of activity: February is always a four-paycheck month, but it’s also like a test run for March. (I now know when each statement period will end in March) I spent the month juggling my day job, designing my costumes for a new show, working on my blog and six-month-out wedding stuff.

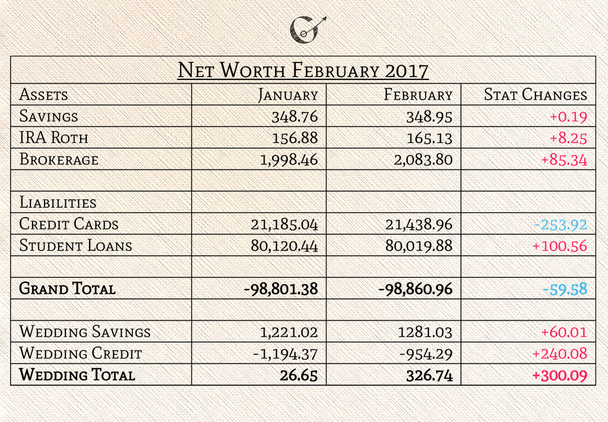

Income Unusualness: Nothing out of the ordinary this month. The design gig doesn’t pay until the show strikes, so I will see that in March. Overall Budget: Into month two of an increasingly tighter budget and I'm getting used to it. There were no problems this month. I barely looked at the new leftovers section this month. I'll try it again in April to see if it will stick around. Budget changes: I think I've adapted to the $25/week for groceries and baton passed it into March's five-paycheck budget to free up an extra $25 for the month. I think switching the Rent and Credit Card leftovers was good for rent. However, this month I didn't really use the leftovers section much because I was purchasing costumes on my credit cards and reimbursing them. Reimbursement usually counts towards my amount due, so I didn’t pay much attention to leftovers. April it may be a helpful tool again. Net Worth: It was not a bad decrease. A $60 change is pretty close to the $50 change of last month. With the consistency between January and February, I feel as though I may actually have a wrap on my finances. But I mustn’t count my fury swipes before they hit. My credit card spending still continues to be my biggest issue, which is why I'm constantly working on it. My design gig does not seem to be muking up my finances the way it usually does and I think next month may bring a heal order for my net worth. Savings Accounts: The wedding account is still going strong, although it spent the month storing its energy. Our line of credit to savings ratio grew some which is good. Instead of putting money into savings, we paid off credit this month which is equally as helpful. Ally is still waiting to find out what happens to that $173 after I file taxes this month. Any egg account, HM02 account, and an unemployment account dreams I may have are on hold until after the wedding. Investments: My Roth IRA, still all in Nintendo stock, did better. At work, I was reminded as we discussed the release of the Switch that it's more important to leave the retirement funds alone at the poke pelago to grow than to constantly trade. My Acorns is currently giving me a market gain of 5.98%, with a total loss of 3.39%. (The total loss includes the monthly $1 fee) It was growing strong and hopefully, it will continue working up its strength with a freshly redistributed portfolio. Blackrock grew a bit which is always nice to see. I plan on starting an UTMA investment account, or saving for one, for my nephew in March. Credit Card Relationship: I used all of my Amex sticker pp (limit) and only one of my Visa pp. My goal for March is to barely use my credit cards at all. I also am giving up carrying my Amex with me for lent. Credit Card Extra Thoughts: I think with this show I have finally learned how to use my personal credit cards for a show. I finished this project not feeling a need for a business credit card. If I eventually get a business card, I think I want two that are different types and have different statement dates. I realized this month that by having different statement dates I can juggle the cards easier to make sure the returns go on the correct statement periods. Student Loans: These continue being constant with UAS and ASC going down and Nelnet going up. My total went down again, which is becoming a nice consistent stat change. I noticed this month that my UAS and ASC interest gained is small and that some of my interest rates are below 2%. So I'll keep fury cutting those two until I can't anymore. Other notes: The blog is going well. Juggling designing, blogging, and wedding stuff did not leave me much time to figure out google ad sense, so maybe this month. I've also decided that I should not take any more design gigs until after our wedding. It was an easy minun of a month! March will be a nice recovery month I imagine. How was your February? What adventures did February bring you? Did you also have an ultra-productive month working side hustles? Further reading: Rockstar Finance's "Blogdex" Net Worth Tracker- over 200 other bloggers’ net worths January 2017 Review and Net Worth Update- Last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My fiancé’s finances are not included. I include our wedding accounts on a separate line because it’s a gray area I haven’t figured out yet. The numbers are taken from each month’s statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing because I can look at just the numbers without any attachment, emotional or otherwise. (In my excel file, I don’t use commas either) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file they are all in black)

0 Comments

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed