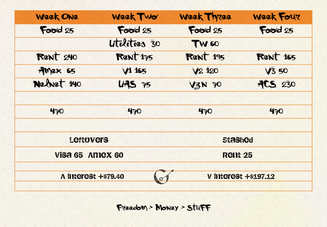

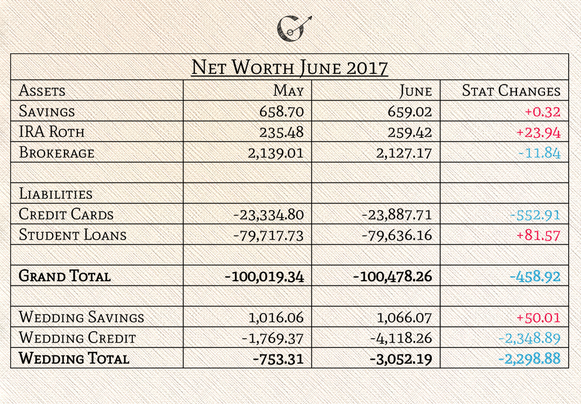

Welcome to July! The first week in July means that it’s time for June’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me pay closer attention to my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend tracking net worth because it has been such a helpful tool to see my personal finances stat changes all in one place. Summary of activity: It was another busy pre-wedding month. We got a lot accomplished, but there is still plenty of work left. Work started the month thrashing about, but calmed down once I got an assistant and a new supervisor. In the next week, or so, I need to have another discussion with my boss about a raise. The most exciting and trubbish part of June was that our rent checks were taken from the mail and endorsed by not someone who is not our landlord. Everything that has gone into working with the bank, fraud claims, paperwork and working with our landlord’s office has stolen a lot of working hours throughout the month. We are almost through the Winding Woods to the Pokémon Village. Right now we have to wait until the landlord returns from their holiday to sign an affidavit that is due very soon. Income Unusualness: Due to the Rent Check Fiasco, I had a few weeks where I was unable to work the number of hours I needed to reach my budgeted paycheck. So my income was not as consistent as usual, which I was thankful that it was a five week month. Overall Budget: In the process of recovering from the Rent Check Fiasco, we were advised to create new accounts and close our old ones. Since it happened in the middle of the week, the banker put a freeze on my “at risk” account because I had a direct deposit scheduled to go into it. The freeze allowed only money to go in and prevented it from going out. Once my paycheck direct deposited, it was trapped until only that banker could thaw the account and withdraw the money. That took a longer than it should have because I didn’t make it to the bank on Saturday and the next time she was available was that Tuesday. This setback caused a brief ripple effect that should be steady by July’s first paycheck. The inconsistent paycheck amounts and receiving some money later than expected caused some bill payments to be late. With all of this happening, I did a muking sludge wave of a job preparing money for June’s wedding and just used credit.  Budget for July 2017 Budget for July 2017 Budget changes: July is basically based off of May. I lowered my budget for my phone bills to more accurately represent my bill so I may increase my utilities based on our electric and gas bill increase. Net Worth: Although my net worth continues to drop, at least it didn’t drop by the hundreds this month. My net worth has dropped like this before, and I was able to recover. I can figure out this one too. Savings Accounts: I thank Shaymin that Ally has a high-interest rate so it can continue to grow even when I can’t add savings to it. Investments: My Roth IRA is doing quite well. I’m glad to see bulk up all on its own. I want to find more money to keep adding more to it. Too bad I can't use this money until I retire, but hopefully in forty years, there will be much more available. I'm glad I managed to start this before I was 30. My Acorns is currently giving me a market gain of 7.71%, with a total loss of 2.36%. It’s about the same as last month, mostly because I haven't figured out how to link my new checking account to it. Blackrock went down this month as it rides the rapids of the market. Credit Card Relationship: I felt like my credit cards and I were fine, but then I saw the numbers. Although I locked up my Visa last month, I had already bought a laptop just before locking it up. It was worth the purchase but hasn’t made my net worth happy yet. Besides the late payment, courtesy of the Rent Check Fiasco, my Amex feels pretty good. I am worried that it will show its true colors in July’s statement. I’m not super pleased with my relationship since last month. I do realize I chose to attend a destination wedding in both May and June and use my card to pay for them. It was worth the debt, most certainly, but I just need to remember that as I figure out my next turn. Credit Card Extra Thoughts: I have not considering getting a new credit card this month. I have been debating locking both up for a little bit. I started a list of things that I would purchase with credit over the next month, like new shoes for work and sunblock. I will probably take a look at my list, and my student loans payments and come up with a plan. July may just be the perfect month to use my excess student loan payment money to substitute my credit cards. Student Loans: They are skill linking their spike cannon and staying the course. UAS and ACS are going down, while Nelnet goes up. In July, I may not make overpayments the way I like to in order to use less credit. Wedding accounts: Our wedding savings is growing slowly, but the line of credit has withstood its biggest critical hit yet. It will just have to withstand more and more damage until after the wedding. Other notes: I continued the discussion about a possible raise with my boss, but nothing has come of it yet. Unfortunately, they were really busy in June, so our discussions were short and sweet. This month I will need to push more it if I want it since I think I have a month before my opportunity closes. We renewed our lease for two years! Rent will be increasing by $150 a month, $75 for each of us, in September, so a raise will definitely help me afford the increase. It was another exhausting minun of a month. I just need to rest a little. Now that I’m refreshed, it’s your turn July! Let’s chat: How were your finances in June? What summer activates are you looking forward to? Further reading: Rockstar Finances Blogdex Net Worth Tracker- almost 350 other bloggers’ net worths May 2017 Review and Net Worth Update- Last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My fiancé’s finances are not included. I include our wedding accounts on a separate line because it’s a gray area for me. The numbers are taken from each month’s statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing by removing any prior attachments, emotional or otherwise, so I can look at the numbers as just numbers. (In my excel file, I don’t use commas either.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file, they are all in black.)

2 Comments

7/2/2017 12:01:10 pm

Mkay, so I have no clue where I found your blog at, but as one Pokemon trainer to another, THIS IS AMAZING. New favorite blog? I think so. :) Anyhoo, sorry to hear about the rent check; that is such a mess. Ugh.

Reply

7/2/2017 03:03:30 pm

Fateful encounters happen. I'm glad you found it and that you are enjoying it. With a little help from an Alolan Muk to help clean everything up, everything will be fine. Thank you!

Reply

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed