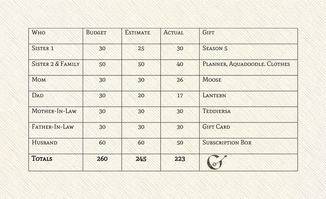

The year of 2015 brought an evolution to how I saw my personal finances. I had a strong budget that was flexible enough to adjust for a month out of town. I also started working on my credit card relationship by limiting my spending with PP. That Christmas season I over-swiped and I could visually see that I had no control over my Christmas spending. A year later, I knew I needed to start preparing for Christmas earlier than I had the year before. In October, I started odor sleuthing what I wanted to buy my family and started to build up a plan. I used an Excel template to track my present ideas and the credit I used to purchase them. I kept a keen eye out for deals and ended Holiday Season 2016 without using any extra PP. This year I want to track a few more things with my Christmas budget level it up into an even more useful tool.  Christmas Present Budget 2016* Christmas Present Budget 2016* Making My Plan I knew that I respond best to something visual, so I started by looking up templates. I found an Excel template that was designed for tracking Christmas Expenses with a section labeled "Budgeted", "Estimated Price" and "Actual Price". I was infatuated by these three categories because they were a digital illustration of how my mind was attempting to budget. I had an idea of what I wanted to spend and how much my present ideas would cost, but this budget provided me a place to track all three pieces of information, side by side, instead of relying on my memory. After making a list of who I was buying presents for, I went through and decided how much money I thought was a fair amount to spend on everyone. Once I saw the grand total, I did a little adjusting and balanced it. I settled on a $260 budget with a mental $40 buffer, in case my experiment didn’t work as planned like in 2015. Present Ideas Tracking This template gave me a section for tracking gift ideas. This was a lot more helpful than I expected it to be. I wrote down my ideas as I thought of them. Then, with the help of Amazon and Google, I entered price estimates for each idea. Then I compared which present ideas would work best with each budgeted amount. With this tool, I rationalized purchasing my nephew three presents, instead of just one, since all together they cost much less than budgeted. Already knowing what I was getting and having an estimated price gave me a keen eye for shopping saving on purchases. Black Friday, one of my favorite holidays of the holiday season, is a popular and established time to look for sales. There are also huge sales with deep discounts randomly through the a when a store is closing, moving or when they just need to make room for new stock. I also added what I could to my Amazon wishlist to watchog the price over time. Execution Taking the time to develop a plan early in the year helped me stay under budget. I purchased a few presents on sale and others I bought as soon as I found them. I had one present that was on sale when I took its estimate, but I bided too much time and eventually bought it at full price. I found another present that was similar to what was on my list but more affordable, so I bought it instead. They seemed to appreciate it just as much as I think they would have the original one. Usually, when I use a budget and purchase something for less than what is budgeted, I baton pass the unspent money to boost the purchasing power for something else. However, I set a goal to not baton pass last Christmas, and I succeeded. Although baton passing budgeted money can boost spending power, my Christmas spending was mostly credit. The least amount of credit I can spend now, the better it is for my finances in the future. Changes for the future As helpful as this budget was last year, it has been even more helpful this year. It shows me how much I can expect to spend and informs me how much money to stockpile for this year. I want to future sight for the holiday season next year. I will be including a few new sections this year: travel, shipping, food and unown expenses. Travel- My husband and I are at a point in our lives where we alternate which of our families we spend the holidays with. This year we are flying to the Montana region which costs a bit more than our flights to the Wisconsin region. By tracking how much it costs over the next couple of years, I hopefully will know what is a fair price so I can quick attack before the price rises and we get magikarped. Shipping- Since we live far from our families, it is easiest for us to ship online orders directly to our parents’ houses. However, we usually do some local shopping and need to ship them as well. By tracking how much it costs to ship presents over the years, I hope to be able to add a budget line to estimate how much to stockpile for getting our presents where we want them. Food- Although our families do a marvelous job of treating us like we are back from college, someday [meaning not yet ;)] I would like to be able to financially contribute to a meal or snacks. There are also holiday parties most of December and I would like to bring something more to pot lucks than just a bag of potato chips. Unown Expenses- These are hard to track since the list will surely continue to grow and change each year. Right now, I want to track things like gas, movies and the occasional museum during the holiday season. It would be nice to get an idea of how much extra money is a good amount to keep on hand. By phantom forcing my budget in October last year and now, I don’t have to worry about overspending during the holidays this year as I used to. I enjoy giving presents to my loved ones and am glad I am on a journey to be able to afford it. Let's chat: How do you prepare yourself for the holiday season? Further reading: What Black Friday Critics Miss- She Picks Up Pennies The Best Time to Buy Anything During the Year- LifeHacker *Illustration is a simplified version of the original document.

4 Comments

Great post! I do a similar plan with a set dollar amount for everyone. I've been trying to cut back on the overall budget. To reduce guilt from spending less, I've been giving an extra little homemade gift to each person (like cookies, fudge, kahlua or spiced almonds). It's hard to find a good balance. I want family to enjoy the holidays and also not break the bank!

Reply

10/30/2017 01:44:10 pm

I like your idea of little homemade gifts. It seems like a great way to give gifts paid for with time and love to volt switch in place of money.

Reply

10/16/2017 08:27:29 am

Ahhh, if only we could all have False Swipe that would keep us from going over the limit with our spending. ;) Also, I love that magikarped is a verb!

Reply

10/30/2017 01:52:16 pm

Those are great suggestions too. Those sales sound great and also make good backup gifts for when you need a quick gift. I can't wait until my credit cards are trained to the point to be used as a strong resource like your cashback. That's a brilliant strategy!

Reply

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed