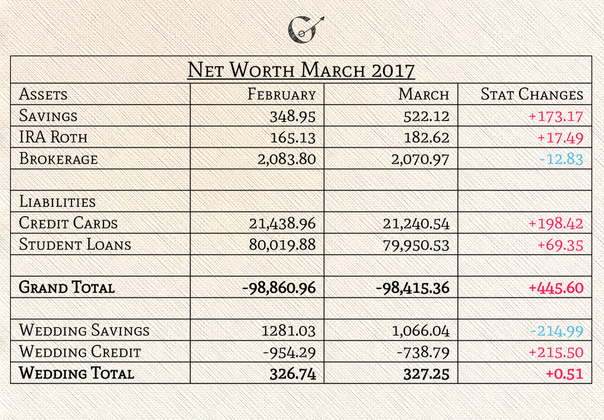

Happy April Fool’s Day! This also means that it’s time for March’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me pay closer attention to my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend tracking net worth because it has been such a helpful tool to see my personal finances stat changes all in one place. Summary of activity: March was a five-paycheck month which meant an extra paycheck to power split across my bills. I filed my taxes this month and learned that I earned more in 2015 than I did in 2016. Besides that, it was a rather calm month of wedding prep and visiting the doctor and dentist.

Income Unusualness: I got paid for the show I designed in February and I received one-third of my tax refund. Overall Budget: I thought I adapted to my $25/week groceries budget, but this month I was reminded why it was $30/week. Groceries are just more expensive in this neighborhood and I’m currently too busy/lazy to find affordable alternatives. So, I'm going to try one last month at $25/week and see if I can still do it or if I need to sharpen it back up. I saved some extra rent money for the next couple of four-paycheck months. Budget changes: I got a newer phone this month, so my phone bills will be higher and thrash about until I pay it off. I also created a stashed section to track rent money I stockpiled in March for April and May. Net Worth: I am glad to see a sharp increase this month. I feel like every five-paycheck month should increase since I have an extra paycheck to razor leaf bills with. I think April and May may receive some recoil damage from putting my medical bills on my credit cards. I also see financial whirlpools ahead as we surf closer to our wedding date. Savings Accounts: The wedding account is still going strong, and our line of credit to savings ratio is still positive, which is good. I expect this to change since we have at least one trip a month during the next three months to finish onsite planning while attending other friends' weddings. We're reaching our victory road of wedding planning. Ally grew some from my design-gig paycheck and it could finally swallow the money stockpiled to pay taxes. It will also be quick guarding the other two-thirds of my tax refund when it arrives until I can figure out what to do with it. Egg, HM02, and unemployment accounts are on hold until after the wedding. Investments: My Roth IRA, still all in Nintendo stock improved. One option for my other refund money is to put it in here. My Acorns is currently giving me a market gain of 5.69%, with a total loss of 3.39%. It's not great, but at least it's doing more than a magikarp splash. Because of my newer phone, I haven’t signed into the app and just spent the month blindly letting it do whatever. I was quite refreshed to see it is doing fine. Although I liked my other portfolio better, this one is doing fine. I won’t see a real change until it's time to change again. Blackrock went down, but it just flows with the market. I haven't started an UTMA investment account, or saving for one, for my nephew yet, and don’t know when I'll get to it. Credit Card Relationship: I used all of my pp for both my Amex and Visa this month. I did a good job not using them until the second half of the month when I needed to pay for my dentist and doctor visits. I also spent some on small things. Credit Card Extra Thoughts: Another option for my other refund money is to pay back some of my credit cards. Student Loans: UAS and ASP continue going down while Nelnet goes up. My total seems to be a consistent decreasing stat change which is great to see. I used my one third tax refund money to double this month's payment for my UAS loans. We'll see the damage from that move come into play next month. I may also use the rest of my refund money towards Nelnet. Those loans are speed boosting and I know that all of that money will be go straight to paying off interest, which will be handy during tax season next year. Other notes: The blog is going well. I have no worry seed about getting income from it quite yet. Right now I am enjoying it being ad free and just focusing my attention on my content. Although I haven't received my other refund money yet, I am struggling to figure out where to direct it to do the most damage and be the most helpful in the long run. I have the ability to grow my retirement, attack either my credit cards or my student loans or a little of all three. It was a lovely plusle of a month. I’m ready April, let’s battle! How was your March? Have you finished your taxes yet? What do you think I should do with my other refund money? Further reading: Rockstar Finances Blogdex Net Worth Tracker- over 200 other bloggers’ net worths February 2017 Review and Net Worth Update- Last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My fiancé’s finances are not included. I include our wedding accounts on a separate line because it’s a gray area I haven’t figured out yet. The numbers are taken from each month’s statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing because I can look at just the numbers without any attachment, emotional or otherwise. (In my excel file, I don’t use commas either.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file they are all in black.)

0 Comments

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed