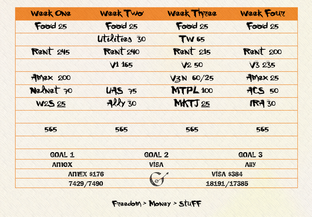

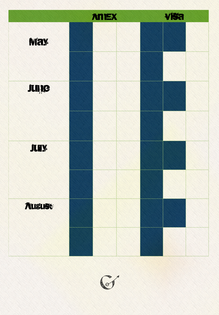

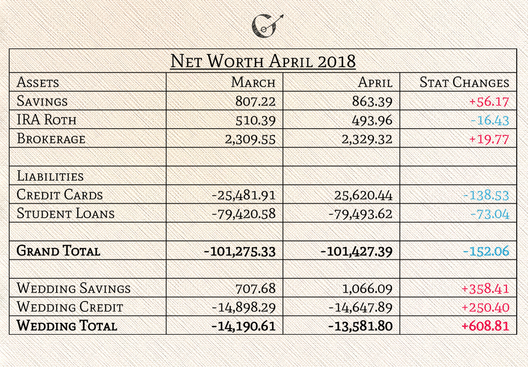

Welcome to May and it’s time for March’s Financial Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me keep a keen eye on my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend both because they have been such helpful tools to watch my personal finances stat changes. Summary of activity: April became busy in and out of work. At work, the month began like a slakoth but evolved into a vigoroth. I started it by doing some spring cleaning in the office. Once we started a new project, I hit the streets doing what I do best, finding the unique fabrics and materials we use to bring the designs to life. I just kept fury cutting with my own projects. I began April by facilitating the discussion at BiRequest, a twice a month peer support group for the NYC Bi+ community. The next day I was hired as a costume design assistant when the original assistants unexpectedly emergency exited with a week and a half left. The baton pass worked nicely and I guided the show to opening night. My Bi+ Family Potluck Picnics have all of the permits submitted. I have one granted, two awaiting security deposits and one still being processed. I am super excited and am learning so much for next year’s encore. My husband and I also made it to the Irene Sharaff Awards, a national gathering to celebrate and honor costume designers and artisans. Besides catching up with other industry leaders, the awards got me involved with a new group of people schooling together to protect the small businesses being pushed out of the garment and fashion district of New York City. So, now I have another project to work on. Meanwhile, the blog is just trying tread water like a Hoenn swimmer. Net Worth: I foresaw a decrease coming. I knew my March dentist check-up had high horsepowered my credit cards in the face. My student loans are also not doing so well, but I will keep a keen eye on them. Hopefully, a temporary budgeting adjustment can help my credit cards recover some. Income Unusualness: At the beginning of the month my weekly workload had dropped to about 35 hours. I have figured out I need about 38.5 hours a week to reach my current weekly budget-HP. Fortunately, the assistant gig covered those missing hours. The rest of my assistant paycheck was stockpiled to save for a new cell phone. As work increased over the month, my paychecks psyched up accordingly.  Budget for May 2018 Budget for May 2018 Overall Budget: Since I started the month a little unnerved, I needed to use some assistant money for my rent. Other than that, everything went well. The extra $20 a month that I budgeted into April worked out well and I plan to keep it... for now. Budget changes: I have adjusted my student loan meal plan for the next three months by moving $80 from ACS to my credit cards as an attempt to lower my credit debts. I think it might make a positive difference to my credit card balances and I am interested in seeing how it affects my student loan debt. Savings Accounts: My savings accounts are doing well. I also have $600 in claimed savings, money biding for a new cell phone, and $150 in fun money from my parents for an Easter present. Investments: My investments are just splashing about. I still need to figure out which stocks to purchase with my $100 for my IRA Roth. I am not seeing anything that I am interested in at the moment, especially since my last purchase has been losing money ever since. My Acorns is currently giving me a market gain of 10.33%, with a total loss of 1.17%, (an increase from last month). Blackrock has passed the Whirl Islands and is back to its smooth surfing of the stock market.  Credit Card PP Tracking Sheet for May-Aug. 2018 Credit Card PP Tracking Sheet for May-Aug. 2018 Credit Card Relationship: April had my credit card relationship feeling steadfast. I used some extra credit card PP for what I thought might be responsible things. For my Amex, I used the general PP for pizza and dinner with friends, and the ether paid for plane tickets for Wedding Season 2018. (HM02 would be worth its weight in goldeen these days, if you know what I mean.) As for my Visa, I used the general PP for tickets, notebook storage, and the ether paid for home essentials, like toothpaste, and summer picnic park permits. My New Year’s goals status is, Amex: Reached!! & Visa: Still Working. I am a little concerned about how the flights may taunt my Amex balance back into "Still Working" territory, but we will see next month. When I updated my PP sheet for the next four months, I gave my Amex a little more PP to see if I can be more responsible with it. I want to keep a nice vice grip on my Visa, so I tried to keep it limited. Credit Card Extra Thoughts: I upgraded my American Express from the Delta Gold Card to the Delta Platinum Card. I realized that although it raises my annual fee to $195/year, I also get a companion ticket every year. These tickets are basically a free ticket for my husband to fly with me with the exception of the taxes and fees. This basically transforms a regular priced ticket into a $195 priced ticket that we were already going to purchase anyhow. Flights into Montana can cost between $450 and $700 for a single ticket. By using a companion ticket, we could not spend over $200 a year! I think in the long run the upgrade will eventually pay for itself. I also scheduled 18-month Plan-It plans to pay off the Wedding Season 2018 flights. I think it makes the most sense to keep interest low, but more on that when I eventually post my Plan-It review. Student Loans: My student loans keep moving ever so slowly forward. My Nelnet loans continue to grow and will until I start paying down that interest poison. My UAS loans are still set to be paid off in 2 years, or as I like to think of it “2 years earlier than they were supposed to be!” That will be a helpful additional $75/month to put towards my higher interest credit cards or my other student loans. Since my main financial goal of the year involves lowering my credit card debt, I want to try to symbiosis some money from ACS to my credit cards for the next three months and see what happens. I want to try it now while my ACS monthly payments are low and can endure a little bit of damage. Wedding accounts: We got a bit more money back with our tax return than I thought we would which was great. The final number bounced almost to where it was in February. In other wedding accounts news, my husband and I had a long conversation about his credit cards. Apparently, he still has over $1,500 on them from our wedding, gaining interest each month. I asked him to switcheroo money from our wedding line of credit to his credit cards so it can stop gaining such high interest. I also want to be able to see those expenses when I track our shared net worth. I want to assist with that debt and I can’t if I don’t know it is there. To also help ease his credit card stress, we agreed for him to use some of our savings to pay for his tickets for Wedding Season 2018. I hope by the end of May our personal loan will reflect all of our outstanding wedding debt. Other notes: We joined Movie Pass for the summer. We will see if it is worth the $10/month. As we start transitioning into beach and wedding season, I make a healing wish that I am prepared. Let’s chat: What experiences did you have during April that helped grow your personal finances? Do you expect anything to bellossom in May? Further reading: Rockstar Finances Blogdex Net Worth Tracker- over 575 other bloggers’ net worths March 2018 Review and Net Worth Update- last month’s review and update April 2017 Review and Net Worth Update- where I was a year ago *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My husband’s finances are not included. I include our wedding accounts on a separate line because I haven’t figured out how our accounts fit into my personal net worth. The numbers are taken from each accounts’ monthly statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing by removing any prior attachments, emotional or otherwise, so I can look at the numbers as just numbers. (In my excel file, I don’t use commas either.) I only show the current month and the one before for illustrative purposes. (My excel file contains the entire year.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file, they are all in black.)

2 Comments

9/12/2021 01:27:39 am

I know its been a while since this posting, but I wanted to send along a note of encouragement - keep working on your net worth and you'll be a millionaire before you know it.

Reply

10/29/2021 03:59:07 am

Thank you for writing this - more people should be financially responsible to calculate their own net worth. I love how you lead by example by posting how your net worth fluctuates from time to time. Making a budget and calculating one's net worth is something most people don't do until they have no other choice. I didn't learn how to budget properly until I was in my late 30s. And even that statement is not entirely true - I didn't care about understanding my own finances. I spent a decade working in academia and a decade broke, homeless, and living with relatives and focusing on my own wounded ego instead of realizing that my financial illiteracy is what was holding me back. I appreciate the dedication you have to inform your readers and I will calculate my own net worth (though it probably won't be much)

Reply

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed