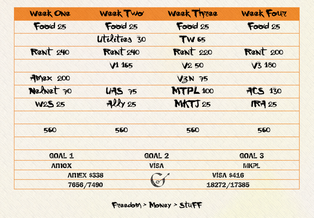

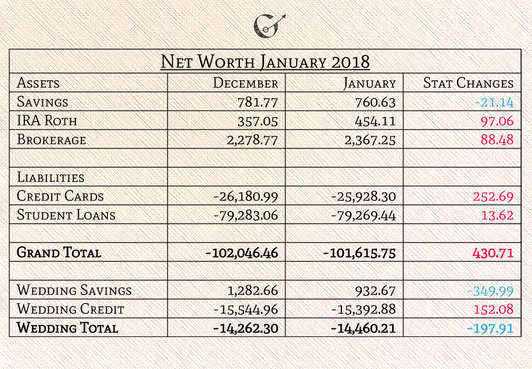

Welcome to February and just in time for the first post of the month, it’s time for January’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me keep a keen eye on my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend both because they have been such helpful tools to watch my personal finances stat changes. Summary of activity: January was a very social month. I even had one week with a different social event scheduled for every night. I realized at the same time I am for sure more of a ledian person than a noctowl person. Even though I went out more than usual, I managed to use real cash for most of my purchases, like pizza and drinks. I also decided this month to cancel my cell phone insurance and to start saving for an upgraded phone. Income Unusualness: I worked overtime two weeks and left some of my extra earnings in my checking account to block me from using my credit cards during happy hour. I also started noticing about a $20 increase as I assume the new tax reform bill began rototilling my paychecks. I currently don’t know how I want to use it, but I hope to determine that in February. Overall Budget: My budget worked like a charm. It felt a little oddish putting so much money towards my credit cards and so few towards my student loans. I have a goal and strategy for 2018 and right now I just need to sticky hold onto it.  Budget for February 2018 Budget for February 2018 Budget changes: I didn't change much about my budget from January to February. There are a few areas that I want to stakeout this month before making my adjustments. By canceling my cell phone insurance halfway through a billing cycle, my bill for February will include an adjusted insurance charge. I am also biding my time to see how consistent the new tax beast boost is before I determine how I want to incorporate it into my financial strategy. I did add a section to track my progress on my initial credit card goal of 2018, reduce my 2017 credit card debt by 5%. I hope that by seeing it as part of my budget, it will encourage progress. Net Worth: Writing about progress, I was super excited to see two plusle months in a row. (Plusle was excited too and couldn’t wait to show off her new Trixie Plusel parody photo shoot.) The big players in January were my investments’ growth and reducing my credit card debt. I hope by copycatting January’s budget, February can do a fair amount of damage too. However, my student loans have me a little unnerved. Savings Accounts: My savings may look like it had a bad month, but it could just be an illusion. This year, I am accurately reporting my Way2Savings account balance by using the monthly statement instead of what it's assumed to be. I also added a line item for my savings section accounting for money I am stockpiling for specific reasons, such as my Switch money for my Amex payments. Investments: My Roth IRA, had a great month thanks to Nintendo stock's increasing value. I also placed an order for a stock purchase for February, but more on that in February's review. My Acorns is currently giving me a market gain of 13.65%, with a total gain of .80%. It's down a bit from December, but February is my month to adjust my portfolio which may help balance things out. I am glad I'm depositing money into my Acorns again. Blackrock just keeps growing. Credit Card Relationship: I used all 2 PP of my Amex this month on date nights. The first for dinner at Drag Bingo. The second to purchase season 3 of Drag Race All Stars. (The main reason plusle was so excited for the opportunity to do her Trixie Plusel parody.) I didn't use any of my Visa's PP because the credit card embargo never was lifted. Having extra cash in my checking account this month also helped with not using my credit cards. I hope to keep that trend going. I like using cash instead of credit because it prevents me from adding debt and I don’t have to mentally add interest to my check when paying. Credit Card Extra Thoughts: I am savoring the Plan It program on my Amex card. I have one final payment to make and my Switch will be completely paid off. After this billing cycle, I will debate if I should use Plan It for my Christmas plane tickets. Substituting the interest from a purchase with a small fee is both a mathematically strong choice and I can see the difference it makes to my overall balance. Student Loans: The total went down, but I can see them adapting to my new payments. Nelnet fluctuated again as anticipated. Naturally, the interest is going to grow faster when my payments do half the damage they were last year. The other two are going down as well, but I expect ACS to start slowing down over the next two months. I read a post from Poorer Than You that reminded me of ways to attack a student loan’s principle when there is no way to aim extra payments at it on their website. In February, I want to start looking into that and see what I can do. Wedding accounts: Our wedding savings will start struggling soon. It is running low and we need to stop relying on it to make our line of credit payments. Fortunately, we are both starting to contribute more to paying our line of credit. It will eventually get paid off, but it will feel slugma-ish... I assume. Other notes: I am feeling very positive about 2018. My finances are off to a great start. I just need to be wake-up slapped every morning and decide I am ready to make my goals a reality. With the delightful return of Trixie Plusel this month, I am ready to work it in February. Let’s chat: How were your finances in January? What are you doing differently for 2018? Further reading: Rockstar Finances "Blogdex" Net Worth Tracker- over 500 other bloggers’ net worths December 2017 Review and Net Worth Update- last month’s review and update January 2017 Review and Net Worth Update- where I was a year ago *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My husband’s finances are not included. I include our wedding accounts on a separate line because I haven’t figured out how our accounts fit into my personal net worth. The numbers are taken from each accounts’ monthly statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing by removing any prior attachments, emotional or otherwise, so I can look at the numbers as just numbers. (In my excel file, I don’t use commas either.) I only show the current month and the one before for illustrative purposes. (My excel file contains the entire year.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file, they are all in black.)

0 Comments

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed