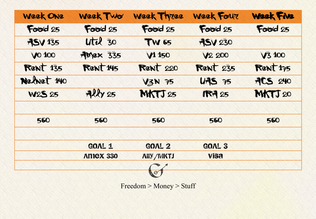

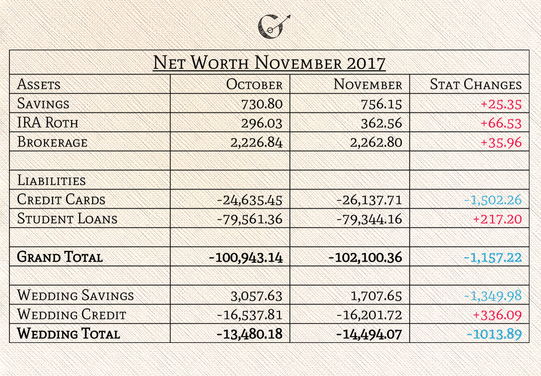

Welcome to December! The first post of December means that it’s time for November’s Review and Net Worth Update. For those who are new to The Grown-Up Pkmn Trainer, each month I write a financial review to xatu my net worth by writing down my thoughts on the previous and following months. I share these summaries so everyone can gain insight into my personal finances and my thoughts behind them. I started tracking my net worth to measure my progress, inspired by Budgets Are Sexy, which has helped me keep a keen eye on my personal finances. I have been tracking my net worth since January 2015 and writing monthly financial reviews for myself since 2016. I recommend both because they have been such helpful tools to watch my personal finances stat changes. Summary of activity: November was faster than October. I started it by spontaneously debating for a week and then purchasing a Nintendo Switch. Then I became sick and missed part of work a couple days in a row. With the healing rate of a shell bell, I bought a handful of antidotes and heal powders and a little bit of the sick still remains in my system. We also planned our Montana Christmas trip and purchased tickets. Then we bought Pokémon Ultra Sun and Ultra Moon, and have basically been playing that since. I finished my sludge wave cleanup by reconnecting my checking account to Acorns and getting my money returned from Digit. Income Unusualness: I didn't work the complete 40 hours one week, but I managed. Now that I work 40 hours weekly, my income has become less variable than usual. Next month starts the annual increase in our company health insurance premiums, which will decrease my paycheck some, but it will still be steady. Overall Budget: November's budget went exactly as planned. I achieved my goal to save a little extra money for rent. I also am super excited that I have made two payments into my retirement account since getting my raise. I believe November's budget will be a sturdy base to build my budgets on for the new year.  Budget for December 2017 Budget for December 2017 Budget changes: I spent some time training September's 5-week budget to grow into December’s budget. I started by raising the weekly goal to account for my raise but kept it slightly lower than my usual 4-week budget goals. This is an old trick room I brought back so I have a little extra fun money. However, it also may accommodate the increase in health insurance premium drained out of my paychecks. I based my usual numbers off of November's budget, but increased payments to my credit cards, rent savings and added a little extra to our wedding accounts. I also stockpiled enough money to spit up later to make my Switch payments over the next three months. Since I have the money now, I figure I can at least earn a little interest on it over the next few months and not worry about including those access payments into my January and February budgets. Net Worth: Well, my credit cards had a huge amount of recoil damage this month. I understand how the math works out. I spent over $1000 of credit to fly to Montana for Christmas, and over $400 on the Switch. It's a big bummer because I thought I was finally gaining some ground. Hopefully, since December is a 5-week month, I will be able to achieve another net gain. Savings Accounts: Like a Vaporeon being hit with a water type move, my Ally savings is enjoying the monthly deposit. My rent savings is also doing well and appreciating the tiny bit of interest. My Way2Savings account was tapped to buy Pokémon Ultra Sun and Ultra Moon. It also had a month without the “Way2Savings” saving money because I made no “debit card" purchases. The robots at Wells Fargo sent me a replacement card recently, but it was an ATM Card, not a Debit Card. I also received my money from Digit and am now debating to close the account altogether or link it back up. Investments: My Roth IRA, is still doing well. It's making a great return this month and I'm making contributions to it. I’m excited to start shopping for other investments to balance my portfolio. My Acorns is currently giving me a market gain of 12.81%, with a total GAIN of .18%. I reconnected it with my checking account this month and started making roundups and deposits to start watering it again. I also realized that I never did my redistribution in August because I was distracted by my wedding and my muked up, sludge covered Acorns. I’ll just bide my time until February and reevaluate it then. Blackrock went up this month as it surfs the market. Credit Card Relationship: I maxed out my PP on both cards. I used my 4 swipes from both of them on mostly "important" things. I used one for my Switch, two for our flight home, two when I was sick, one at the doctor's office and one for Thanksgiving. (The final one was for pizza if those of you counting.) I probably should not have purchased the Switch this month, but I see this as a credit card relationship challenge I am ready for. By using the Plan It method on my Amex, I am able to battle my purchase by replacing interest with a small fee. I am also practicing a healthier way to pay off larger purchases I made with credit. By the end of this month, I should have enough money stockpiled to pay it off over the next three payments. I am hopeful that this will strengthen our relationship. Credit Card Extra Thoughts: I like the concept of Amex's new Pay It Plan It system. I wonder how much I will actually use it in the future though. Student Loans: This number went down again, and I have no idea why. For whatever reason, my NelNet statement didn't grow as much as it did last month. I give up trying to figure it out this year. I've got enough on my student loan plate to be dealing with. My struggle of reapplying for my IBR continues. Nelnet claims they didn't receive my husband's paperwork even though ACS did. I resent them the information they needed and I received an e-mail saying they have received everything and to stop worrying. Hopefully, they do have everything they need since my cut-off date was December 8th. ACS received everyone’s paperwork and have placed me on an IBR plan. At first, I was upset because I just want to pay it off. After talking with someone at the servicer, this was probably the best thing I could have done and probably should have done it earlier. The government will be paying interest on a good amount of these loans for the next two years. They also told me that if I keep paying my usual amounts, they won't dragon tail me out of my plan due to overpaying. I have heard about this happening to other people with other loan servicers and am glad that it won’t happen here. Once I know how much I’ll owe for my NelNet payments in 2018, I can reevaluate how to reach next year’s financial goals. Wedding accounts: Our wedding accounts are present and accounted for. My husband and I discussed how dry our wedding savings is getting. He tells me he’s close to paying off the wedding expenses on his credit card. My magikarp splash deposits aren’t doing enough to keep it hydrated and I don't appreciate seeing it drop $1000 each month. Our line of credit is tormenting me with the interest’s stamina. We paid $500, but our total only dropped $300. Sure we’re doing damage, but the interest just absorbs it all. I feel like our two steps forward include one step back. Other notes: My new financial pokémon team is running the smoothest yet since restructuring. Now, I just have to determine if Digit will stay a part of it. November was a not great blog posting month and has me worried about my blogging future. Meanwhile, the new project manager at work keeps finding me animation/ video game costume design jobs to apply for. My concern with this is that I have committed myself to my current job until 2019 in order to get my raise. I also really like doing my job, the stability it provides and I can see how my experience there benefits my long-term career. I am just trying to figure out the best way to focus my creativity to satisfy me, earn money and work towards a career designing costumes for animated film and theater. It was a brisk minun month, so time to slow down and enjoy December. Let’s chat: How were your finances in November? How do you feel your 2017 is wrapping up? Further reading: Rockstar Finances Blogdex Net Worth Tracker- over 450 other bloggers’ net worths October 2017 Review and Net Worth Update- last month’s review and update *A few notes about my net worth* My net worth only tracks my personal assets and liabilities. My husband’s finances are not included. I include our wedding accounts on a separate line because I haven’t figured out how our accounts fit into my personal net worth. The numbers are taken from each accounts’ monthly statements. I don’t use dollar signs because looking at just the numbers helps me focus energy easier for analyzing by removing any prior attachments, emotional or otherwise, so I can look at the numbers as just numbers. (In my excel file, I don’t use commas either.) I only show the current month and the one before for illustrative purposes. (My excel file contains the entire year.) I use plusle-red, and minun-blue for illustrative purposes. (In my excel file, they are all in black.)

0 Comments

Leave a Reply. |

Bag Pockets

All

Blog

|

© 2016-2018 Tojo Designs/The Grown-Up Pkmn Trainer

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

Most images created for this blog are derivative works based on the copyrighted property trademarks, of The Pokemon Company Internationl, Inc. © 2018 Pokémon. © 1995-2018 Nintendo/Creatures Inc./GAME FREAK inc. Pokémon, Pokémon character names are trademarks of Nintendo.

RSS Feed

RSS Feed